It has been an extended 2022 for a lot of within the inventory market as we have seen all-time highs in early January morph into one of many worst bear markets since 1950. Whereas we have seen a major decline in fairness costs, the market atmosphere now’s MUCH completely different than it was at first of the 12 months – and that is very bullish.

At our MarketVision 2022 occasion on Saturday, January 8, 2022, I used to be extraordinarily cautious. Value motion remained strong, however that was about the one factor the bulls may be ok with. Sadly, worth motion is the one factor that almost all traders take a look at. Accordingly, many had been blindsided when the distribution interval from January via Might happened. Everybody was promoting. All. Day. Lengthy. However that was not the reason for the 2022 issues. It was the EFFECT. The warning indicators had been in all places, when you solely cared to look, or to think about the bearish argument. I keep in mind being soundly criticized by many for calling for a bear market lengthy earlier than the key indices dropped the “required” 20%. As I mentioned then, “you need not see a tornado in your eating room to understand a storm is approaching.”

The excellent news is that 2023 is more likely to be higher. A lot, significantly better. After all, I reserve the appropriate to alter my thoughts between now and MarketVision 2023, to be held on Saturday, January 7, 2023, however a lot has modified for the reason that starting of the 12 months, and it is all been for the higher, besides worth motion. So as soon as once more, the query you have to ask your self is, “are you keen to think about the bullish argument now or are you caught downtrending costs with no skill to look past that?”

Listed here are the 5 issues it is advisable to know NOW:

It is Cyclical, Not Secular

I’ve mentioned this all 12 months lengthy and I am simply as satisfied as we speak as I have been at any level in 2022. We have simply concluded a cyclical bear market, people. It is over. Is {that a} assure? After all not. I haven’t got a crystal ball. I do not understand how a lot crazier Fed Chief Powell may get. He and his Fed cronies tried to destroy Christmas in 2018 through the commerce struggle with rate of interest hike rhetoric that by no means transpired. Maybe he would not like the vacations? However after a collection of BIG rate of interest hikes in 2022, inventory valuations got here crashing down, particularly development inventory valuations. I am seeing decrease charges on the horizon, which can ship those self same valuations taking pictures again increased.

I wrote an article again in January 2022, laying out my “4 Daring Predictions About This Bear Market”. For those who did not learn the article, this could be a good time to take action. Now we have the instruments (particularly right here at StockCharts.com) to coach ourselves, if we’re keen to place within the effort and time. Many technicians are perma-bulls or perma-bears, solely writing articles that assist their biases. I have been referred to as a perma-bull many instances, and admittedly, I am usually bullish. I believe that is a very good factor because the inventory market rises much more than it declines. I hope that anybody who thought I used to be a perma-bull now displays and realizes that I name what I see. Bullish or bearish, it would not matter. I will inform you what I am seeing. Sure, the bulls will get the good thing about the doubt, as a result of once more, the market goes up greater than it goes down.

On Saturday, January 7, 2023 at MarketVision 2023, I’ll inform you what I am seeing and provides my predictions for calendar 12 months 2023. This might be a FREE occasion and everybody subscribed to our EB Digest publication might be invited to attend. If you have not already subscribed, it is a GREAT cause to subscribe. Different related occasions are priced within the a whole bunch, and even 1000’s, of {dollars}. But, StockCharts.com might be becoming a member of us at EarningsBeats.com for our 4th annual MarketVision occasion and it is FREE and really academic. This enables EVERYONE to attend and study strategies that you should use to higher forecast market path and really feel extra assured about your investing selections. Cease listening to CNBC. They’re an leisure channel. Within the phrases of their very personal Jim Cramer, “THEY KNOW NOTHING!” (Really, the massive Wall Road companies know lots, they only maintain it to themselves)

Do you need to attend MarketVision 2023 for FREE and be taught extra in regards to the inventory market? Then CLICK HERE to enroll in our EB Digest publication and we’ll ensure you get room directions when the occasion approaches.

Regression To The Imply

I pointed this out to start 2022, but it surely’s rather a lot simpler to see now. The S&P 500 gained 115% over 22 months main as much as its all-time excessive in January 2022. That sort of appreciation is solely unsustainable. The U.S. inventory market, coming off the 2020 pandemic, ran too far too quick and we had been going to pay the worth in 2022. This is a day by day chart going again 100 years with a 450-day charge of change (ROC) under the worth chart (there are 253 buying and selling days in a calendar 12 months, so 450 days represents 21-22 months of buying and selling):

Because the Nineteen Thirties, we had seen the S&P 500’s 21-22 month charge of change hit 85% solely twice. By the start of 2022, we hit 115%!!!!!! This loopy advance, along with off-the-chart bullish sentiment urged we be extraordinarily cautious getting into 2022. However was CNBC telling its viewing viewers to watch out, whereas the massive Wall Road companies had been quickly rotating to defensive sectors in December 2021? After all not. That does not pay the payments. As a substitute, they will proceed to rotate their seasoned entertainers. For my part, there’s perhaps a handful of true specialists value listening to on CNBC all year long. The remainder will flip-flop or enable their pre-conceived biases shine via, leading to nothing however dangerous analyses and market losses.

Pay attention, when you had been unbiased to start 2022, how may you take a look at the large transfer increased from March 2020 via December 2021 and never no less than contemplate that the inventory market wanted a break? Right here was the S&P 500 15-year weekly chart that I confirmed to MarketVision 2022 attendees almost a 12 months in the past, and the place we stood as of January 8, 2022:

There have been a number of warning indicators on this one chart. First, look again at 2014/2015. We broke simply outdoors the higher channel line and what occurred subsequent? A regression to the imply. Now quick ahead to 2021. It was a breakout above the higher channel line – solely on steroids this time. Then take a look at the weekly unfavorable divergence on the PPO. Bullish momentum was slowing. Observe additionally that the weekly RSI remained above 50 for 18 months. All of those similar situations had been current again in 2014/2015. It was historical past about to repeat itself. Again on the MarketVision occasion, I by no means assured anybody that we’d have a bear market. What I mentioned on the time was that the RISK to the draw back was too nice to stay blindly lengthy. I take advantage of technical evaluation to guage danger, to not assure future worth motion. Those that do not use technical evaluation will all the time level out when it would not work. However that’s not the purpose. We use it to guage and handle danger. That is it.

These inexperienced arrows spotlight “regression to the imply.” Throughout my speak, I identified that, in a worst case state of affairs, I may see one other regression to the imply, so my draw back goal was 3500-3800. This is how 2022 unfolded on this similar chart:

Having this angle BEFORE the bear market started altered the monetary lives of lots of our EarningsBeats.com members – in a great way. On the finish of the day, everybody should make their very own particular person monetary selections. I all the time level out that we aren’t Registered Funding Advisors (RIAs). We’re not making an attempt to handle anybody’s cash and to take action, with out the good thing about a monetary plan and a danger profile, can be irresponsible on our half. As a substitute, EarningsBeats.com is a steerage, analysis, and schooling platform. I might prefer to consider that our work helps our members make BETTER and MORE INFORMED monetary selections. That is all we are able to do.

Sentiment Has Been Reset

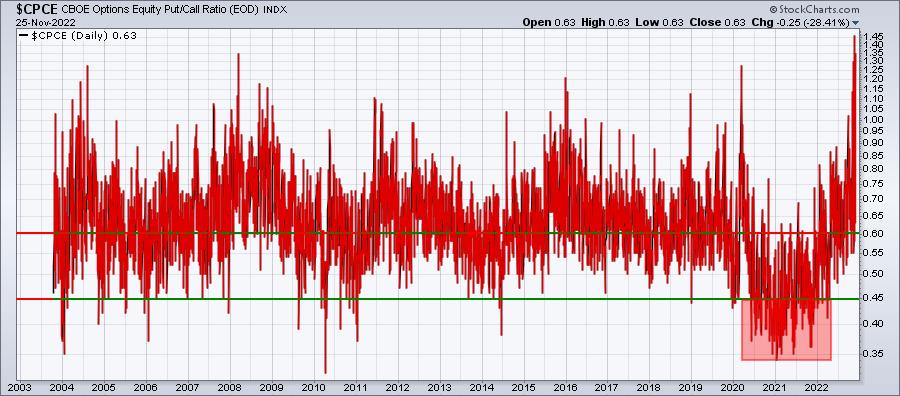

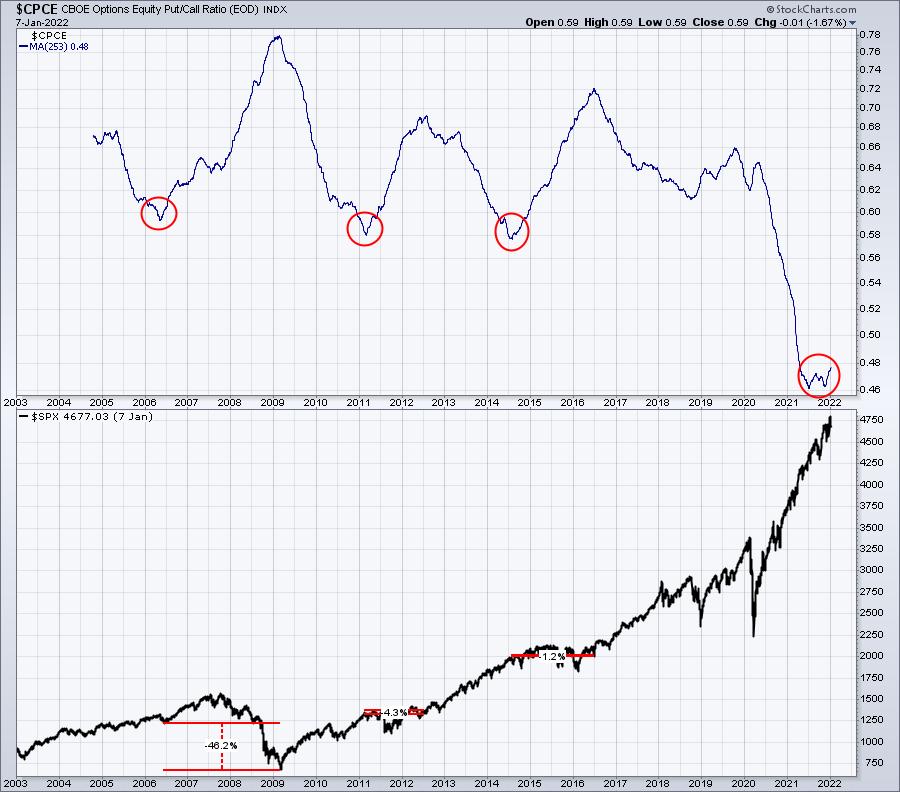

I mentioned in January that our absolute greatest market difficulty was sentiment. It wasn’t inflation. It wasn’t rates of interest. It wasn’t a attainable recession. As a substitute, everybody who wished to purchase had purchased. Retail merchants had been EXTREMELY BULLISH and it wasn’t sustainable. I need to present you two charts of the equity-only put-call ratio ($CPCE) after which I will clarify them:

The CPCE is a fraction, the numerator of which is the variety of fairness places. The denominator represents the variety of fairness calls. The CPCE is a contrarian indicator. When retail merchants develop bullish and are shopping for too many calls, the fraction (fairness places divided by fairness calls) strikes decrease and decrease. When retail merchants develop extra bearish, the other is true and the fraction rises. Over a time period, sentiment tends to shift too far in both the bullish or bearish path.

The primary chart above merely exhibits us this fraction day-after-day for the reason that CBOE started offering us this knowledge. Bear in mind, the decrease the studying, the extra bullishness felt by retail merchants. With this in thoughts, try these day by day readings, notably within the second half of 2020 and all through 2021. Within the red-shaded space, there is a cluster of readings under 0.45. This degree of bullishness was hardly EVER reached within the prior 16 years. By the point 2021 ended, it was the norm. On the flip aspect, take a look at few CPCE readings above .60 in 2020 and 2021. Choices merchants believed the inventory market was a private ATM machine. Simply purchase calls and become profitable. Nicely, we now know the results of that excessive bullishness.

The second chart exhibits us this similar knowledge for the previous 20 years. Nevertheless, the readings have been smoothed out over a 253-day interval, or one 12 months. As retail merchants develop increasingly bullish, this 253-day transferring common continues falling. However as soon as this bullishness is exhausted, the market struggles as a result of there are not any extra consumers and because the inventory market falls, retail merchants slowly start to show in opposition to the inventory market and turn out to be extra bearish. That is what drives this 253-day transferring common increased. This chart is as of January 8, 2022. I confirmed everybody at MarketVision 2022 that this 253-day transferring common was simply starting to show increased. I’ve circled in purple earlier durations when this transferring common turns increased and the S&P 500 outcomes whereas this ratio turns increasingly bearish just isn’t good. We’re usually in a bear market or in a interval of sideways motion. This sign was telling us to not count on a lot bullishness in 2022. We wanted a sentiment “reset”. Try the place this 253-day transferring common is now and the harm inflicted on Wall Road:

I am unsure the place this 253-day transferring common will high, however when it does, we’ll probably be within the midst of the “mom of all rallies”. Some may counsel that we will not backside till this transferring common tops, however simply check out 2016. The S&P 500 bottomed in January 2016 and ran greater than 20% increased earlier than the highest occurred within the 253-day transferring common of the CPCE. This is not an ideal science. The takeaway right here for me is that the sentiment image has fully flipped now – simply as I urged it could a 12 months in the past. Sentiment will now not be a cause for the inventory market to battle.

Divergences Are Now Placing The Bears On Discover

I discussed earlier that weekly PPO unfavorable divergences on the finish of 2021 urged upside momentum was waning, one other contributing issue to a possible market high. Nicely, like sentiment, we have flipped and now we’re seeing that draw back momentum is waning. Try this weekly chart:

Watch the downtrend line close to 4100 and the weekly RSI 60 degree. If we clear each of these, it could be pointing to additional upside forward.

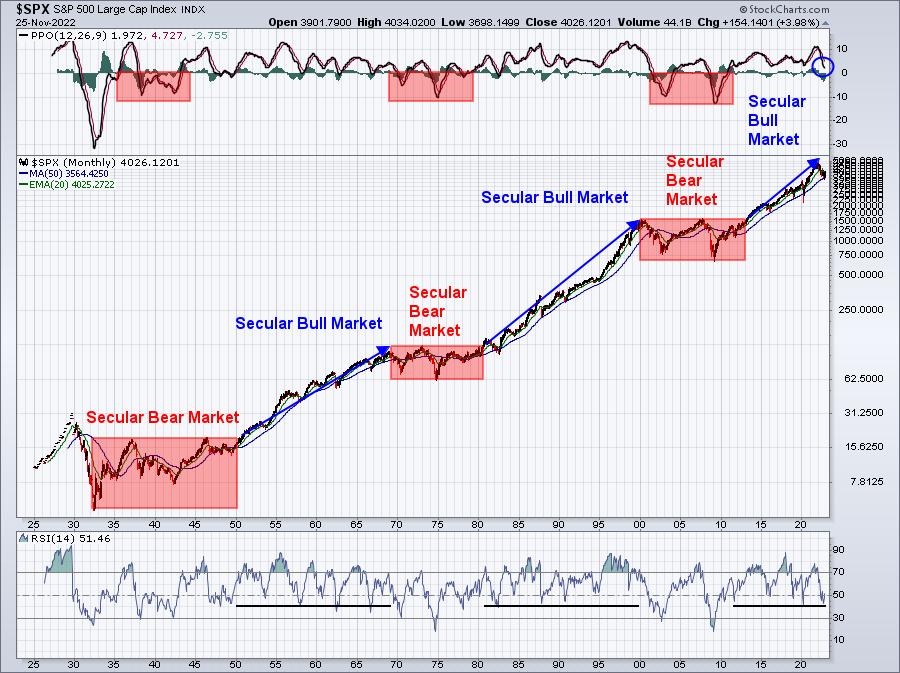

The Huge Image

The long-term chart of the S&P 500 helps the notion that we’re in a secular bull market. It is actually the one chart that drives a lot of my secular vs. cyclical beliefs. Examine this out and resolve for your self if we must always ignore the long-term secular bull market thesis:

Secular bear markets have these widespread traits:

- Month-to-month RSI drops to 30 or under

- Month-to-month PPO drops properly under zero line

- Doesn’t break to all-time highs

Everybody LOVES to guess in opposition to the inventory market, but it principally retains going increased. There are many instances to be cautious and the market will sometimes present us indicators, because it did late in 2021 and into early 2022. More often than not, nonetheless, betting in opposition to U.S. shares is a nugatory effort.

Issues may change over the subsequent couple months, similar to inflation, rates of interest, the Fed, financial issues, and many others., however I might watch out about being overly pessimistic based mostly on all of the technical and sentiment adjustments which have taken place. I’ll evaluation each chart that I really feel is vital and share all of it with everybody at MarketVision 2023 on Saturday, January 7, 2023. Once more, if you wish to be part of this FREE information-packed occasion, CLICK HERE to start your FREE subscription to our 3x per week EB Digest publication.

Our Greatest Deal Of The Yr Is Ending At this time

Our Fall Particular has been working for 2 weeks, however as we speak is the final day to learn from the bottom costs we provide all 12 months. If you would like to hitch our very happy group of EarningsBeats.com members, there’ll by no means be a greater time than as we speak. This is extra data on our FALL SPECIAL!

Comfortable buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person traders. Tom writes a complete Each day Market Report (DMR), offering steerage to EB.com members day-after-day that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a elementary background in public accounting as properly, mixing a singular ability set to method the U.S. inventory market.